Our Investment Philosophy

We Create Portfolios That Match Your Goals

Portfolios designed to withstand market changes

In today’s volatile markets, some clients may want to look beyond traditional investing strategies. They might consider a portfolio with potential to outperform market indices over the long term, while taking advantage of alternative strategies that could help lessen the impact of market changes and provide income.

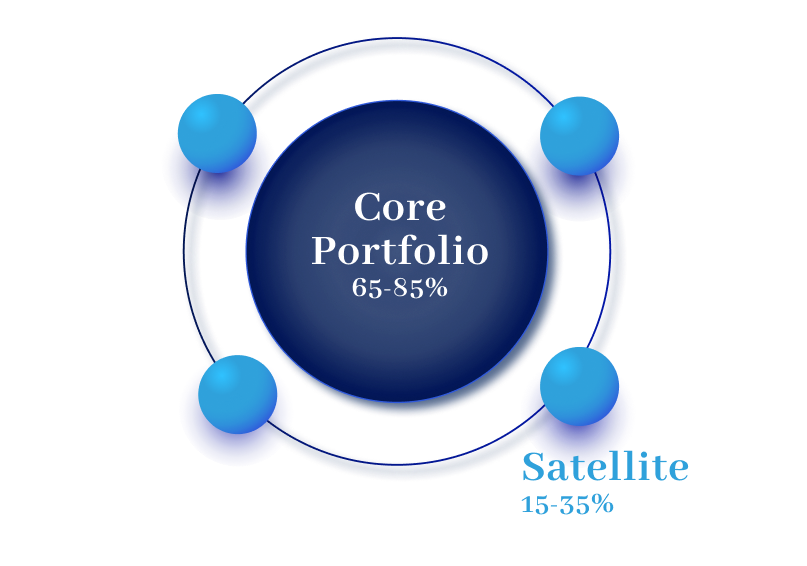

= 15-35% allocation to satellite strategies can be split across multiple satellite approaches.

A Combined Investment Approach

Each investor’s risk tolerance is different. We design portfolios with the intention of meeting the risk tolerance and long-term goals of our clients. To do so, we divide investments into two categories: Core and Satellite.

Core Strategies

Core allocations or strategies are meant to provide exposure to asset classes that are broadly representative of the stock (equity) and bond (fixed income) markets.

Satellite Strategies

Satellite holdings or strategies are meant to complement the core strategy, providing exposure to various asset classes. This could include alternative investments like real estate, market-related strategies, or yield-focused strategies to produce a high level of income.

Investments Tailored to Your Unique Goals

Watch the video below to learn about our investment risk tolerance questionnaire and how your answers will determine your investment portfolio.

Investing according to your risk tolerance

Whether you want to aggressively seek higher income, or secure your funds for retirement, our team will design and monitor your plan to pursue the results you desire.

Let’s schedule a conversation

Contact us to schedule a quick 30-minute conversation with us so we can get a better understanding of where you are right now.

From there, we can make a detailed plan based on your needs.